I can’t believe I’m here. I can’t believe I’m a thousand feet in the air soaring in the sky in a hot air balloon. It almost wasn’t to be.

When Dave and I decided on Turkey as a destination for a winter getaway, hot air ballooning was one of the premier attractions. The most famous place to hot air balloon in Turkey is Cappadocia over the fairy chimneys and primeval rock formations dating back thousands of years. The internet is teeming with pictures of this magical place where the skies are filled with dozens of colourful balloons in the sky at once.

We arrived in Cappadocia in the middle of a snowstorm. Our balloon ride was cancelled the next morning due to snow and the next day due to fog. We had one chance left to take to the skies the following morning in Pamukkale.

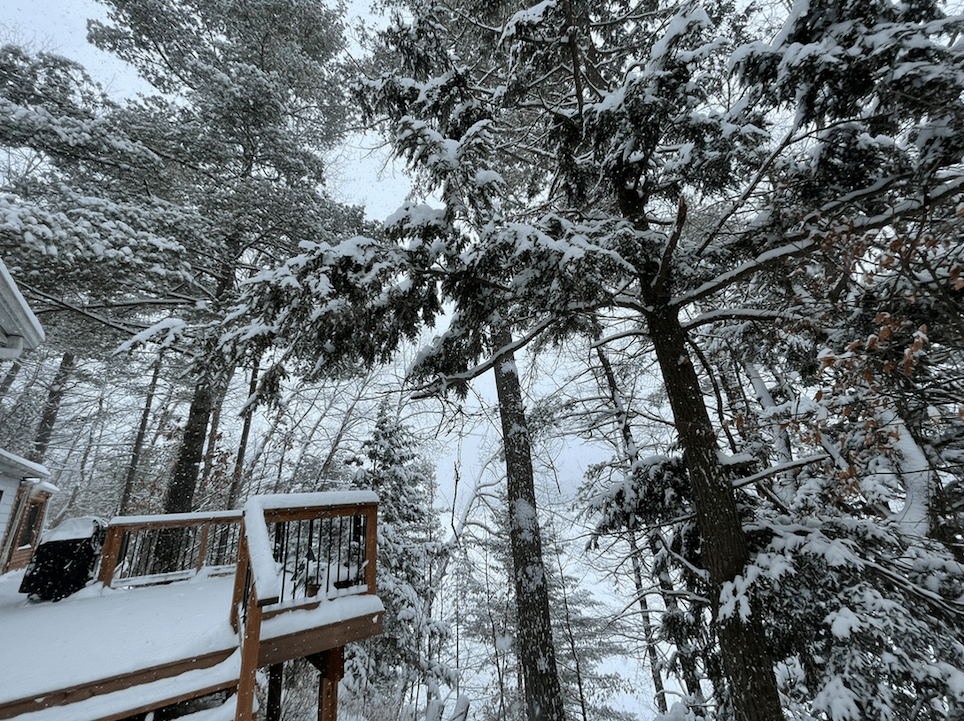

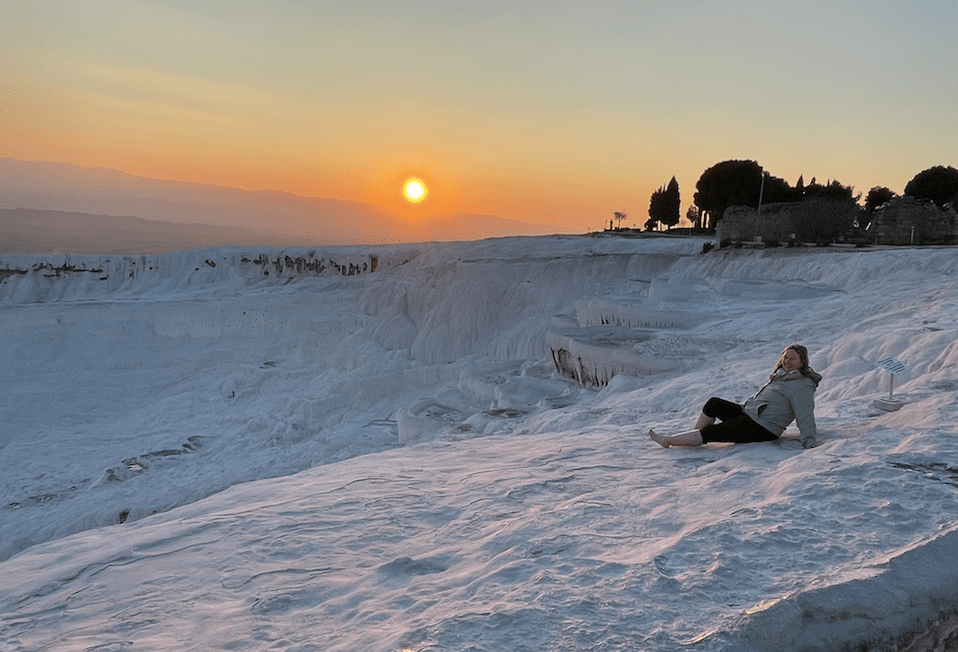

We had toured Pamukkale the day before. It was in fact, my favourite place in Turkey. Pamukkale, which means “cotton castle” in Turkish is a UNESCO World Heritage site famous for its white, thermal pools of calcium deposits the size of Niagara Falls. After soaking in its magical charm at sunset and exploring the ancient ruins of Hieropolis adjacent to it, I was bursting with anticipation to sail above it the next morning in a hot air balloon.

As our transfer took us down through the valley, we could see the first flight of balloons mid-air outside our windows. The sun had just breached the mountains to the east and the air had a soft, hazy glow.

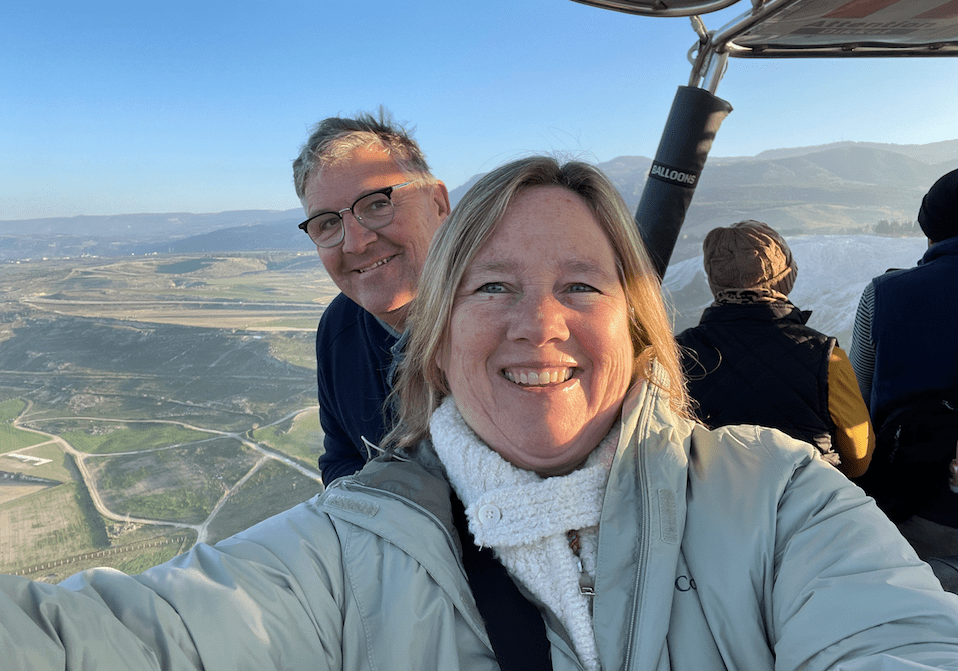

We arrived in a field and watched as the pilot landed the balloon we were about to fly in. They had to balance the weight, so as two people exited the balloon, two of our group entered. It was tricky climbing over the sturdy rattan basket, but the pilot and his crew members were there to help and our group of 12, who had become quite close in our week-long adventures congenially extended helping hands and hauled each other one by one into the basket.

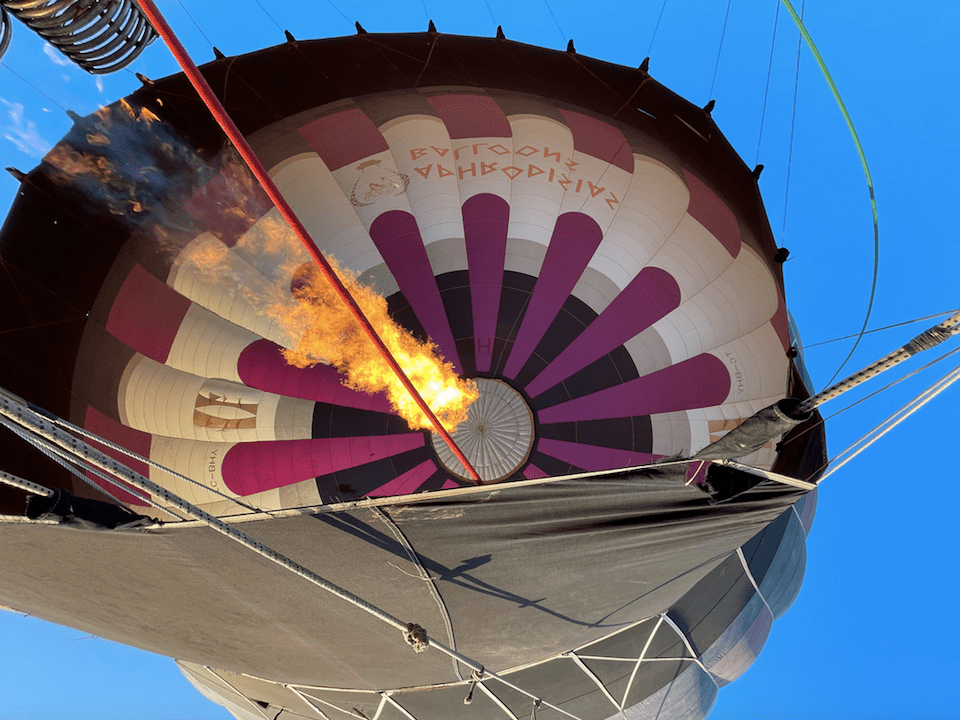

After a quick safety lesson, our pilot fires up the propane tanks. A burst of flames shoots upwards, sending waves of heat into my face as air fills the colourful balloon above us.

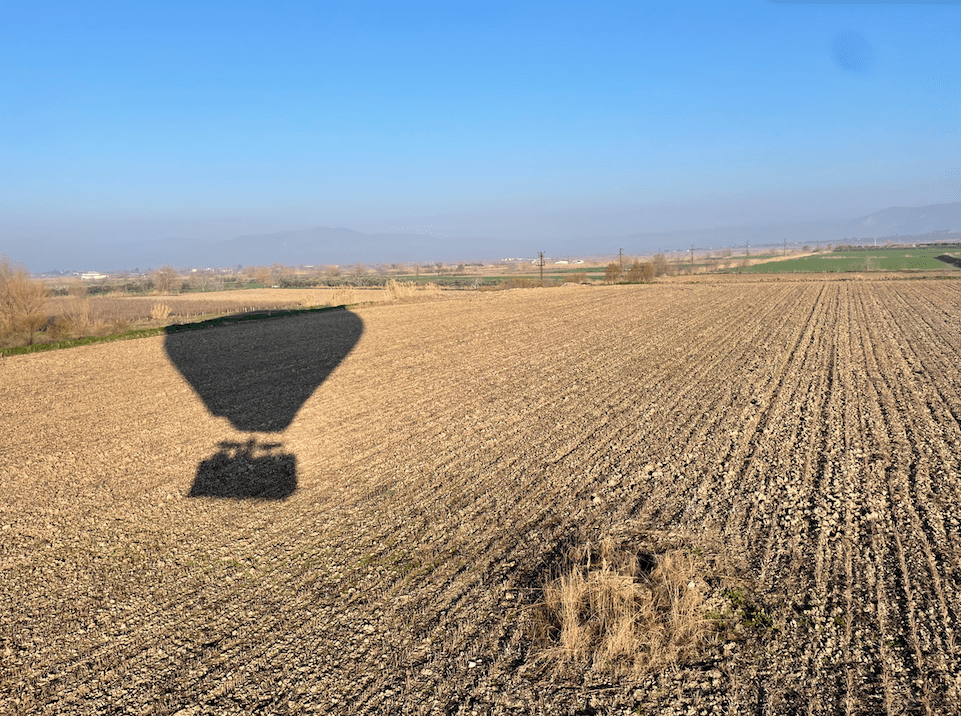

Lift off. The balloon begins to rise majestically, floating ever so gently, gaining altitude as the light from the daybreak casts a soft glow over the hills and valleys.

Our pilot watches the altitude, wind speed and conditions on his control panel. He releases more propane and we rise higher, higher.

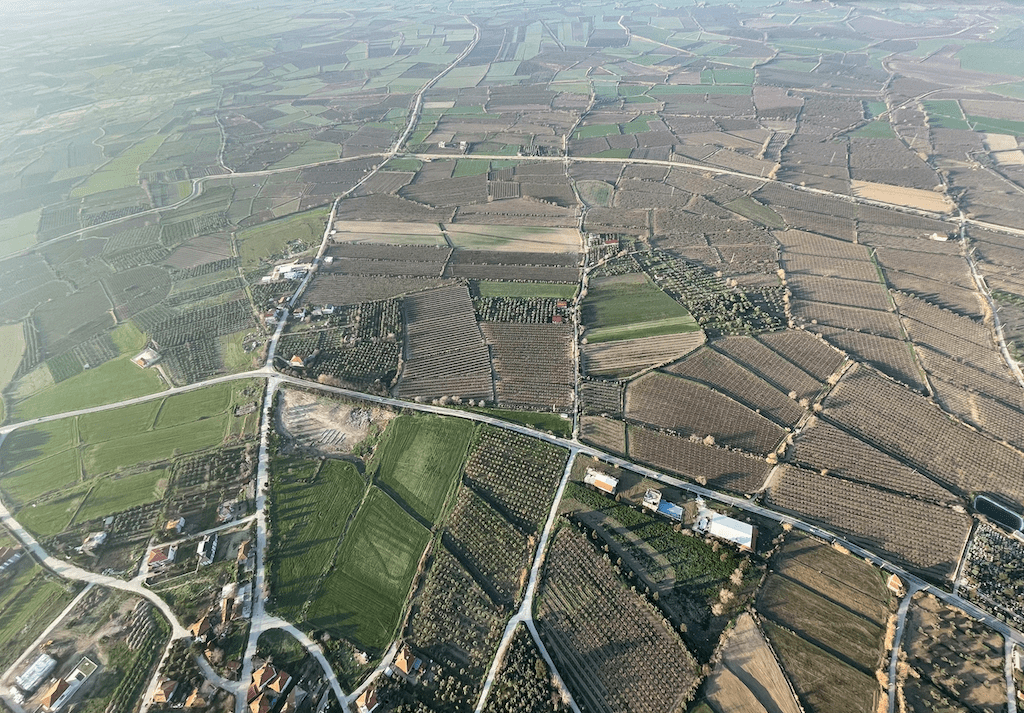

I look down and see a patchwork quilt of vineyards and fields filled with olive trees and grapes and little dots that are houses. There is a large waterpark below us, as we begin to drift towards majestic Pamukkale.

There is a hushed silence, as our group watches in wonder the beauty of the landscape, breathing in the cool air and feeling the warmth of the morning sun on our faces. We are in awe.

A thousand feet. Our pilot keeps turning the balloon from east to west so we can all enjoy the magnificent views of the cotton castle below us and the snow-capped mountains to the west.

We continue suspended in air and in time, floating blissfully, quietly, at peace with the world and immersed in the atmosphere around us.

It is time to land. We had been briefed on how to sit for a crash landing, low in the basket, gripping the handles. As we drift slowly, slowly towards the ground, some of us assume the position. The pilot laughs. He assures us the stance is not necessary, it will be a smooth landing today.

We touch down, barely a bump in a mud-caked farmer’s field. The crew is waiting to greet us with champagne. Another successful flight.

Our hot air balloon ride in Turkey was a magical once-in-a-lifetime adventure. I hope you get to experience something as equally special and meaningful to you some day. See my quick Instagram video here.

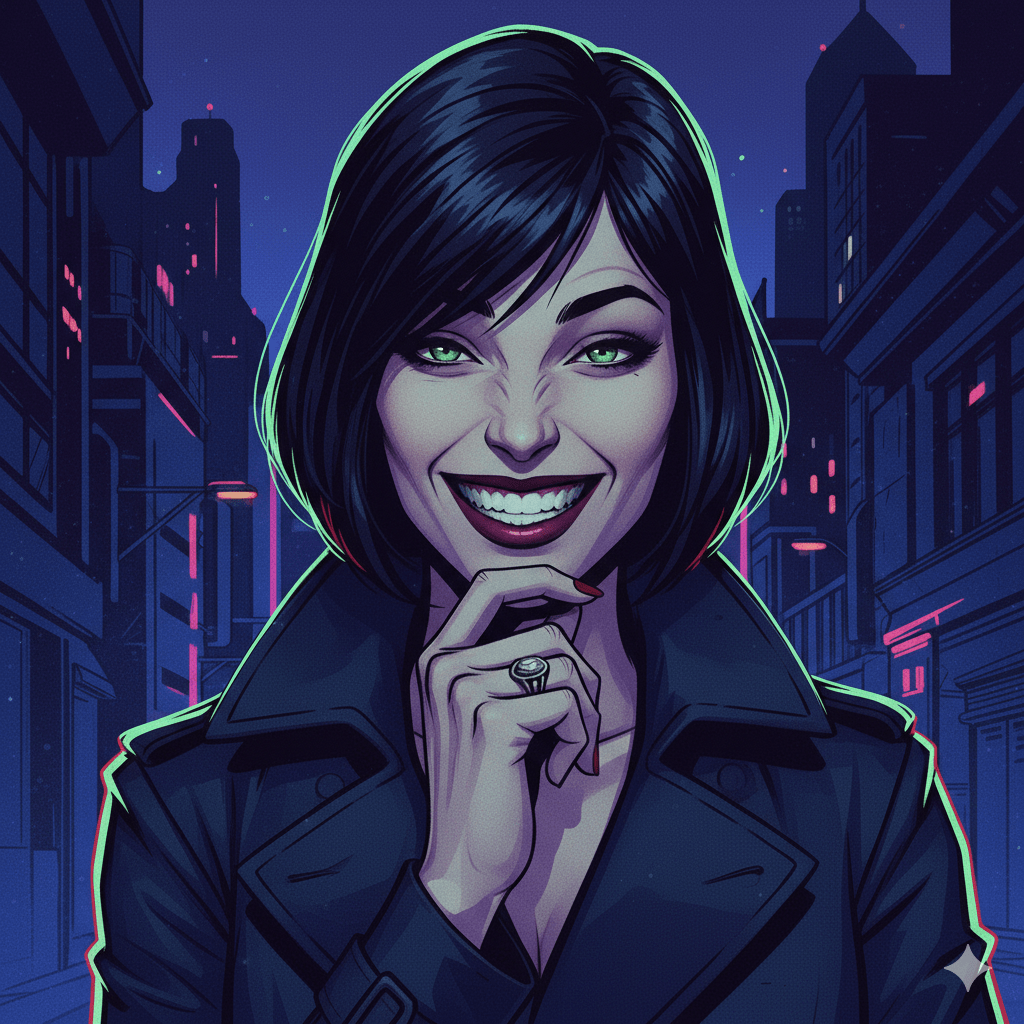

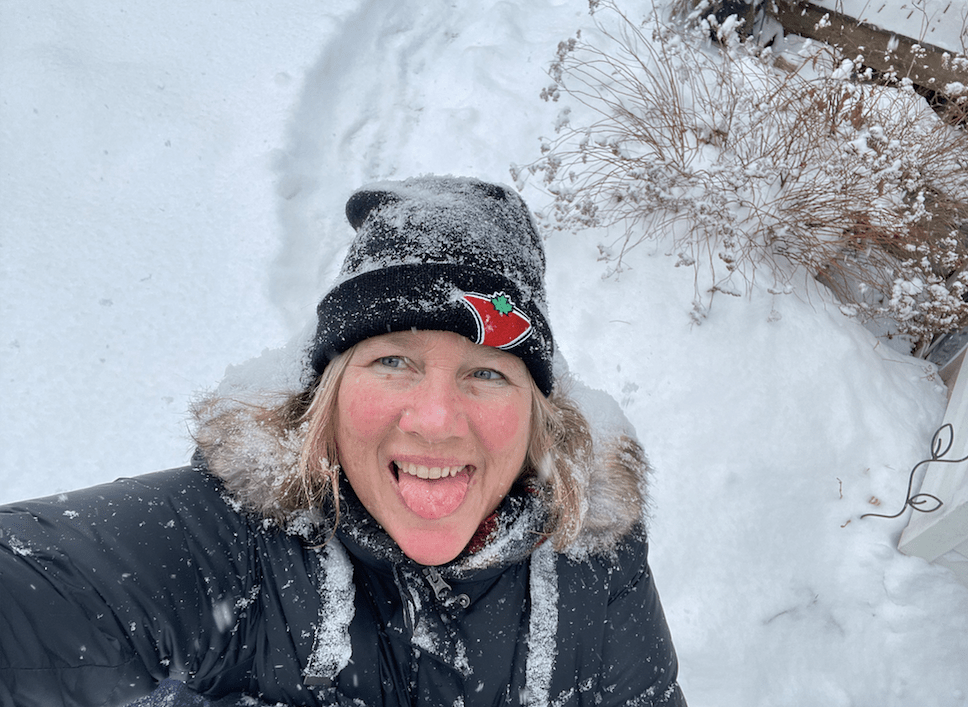

Me at Pamukkale the night before at sunset